Here's What We'll Cover

Widely used in the modern economy, lithium has its own set of ESG-related considerations that companies need to be aware of.

Lithium has become a bit of a buzzword in the sustainability arena of late, predominantly because of (a) its ubiquity as a core component of the batteries powering modern day electronics, and (b) the headline-grabbing rise of electric vehicles that use lithium-ion (Li-ion) batteries to power them.

The sheer number of electronic consumer devices that use lithium-ion batteries (laptops, phones, tablets, etc.) is incredibly vast, and even if Li-ion battery demand was restricted to this market segment alone, it would merit close inspection around lithium usage.

The meteoric increase in the production of electric vehicles over the last few years, however, has added a whole new level of demand for lithium, and raises serious ESG-related issues around the mining, supply chain, production, disposal, and recycling of the metal.

Why are lithium-ion batteries so widely used?

Li-ion batteries have become incredibly popular due to how well-suited they are for their intended use. They are much lighter than other types of rechargeable batteries of the same size and have a high energy density, meaning that they can store more energy than other batteries of the same size. In addition, Li-ion batteries can handle thousands of charge and discharge cycles, giving them an appealing lifecycle duration for consumers.

Due to the sheer size of the market for batteries, there are huge amounts of research currently ongoing directed towards creating batteries which last longer, are even lighter, and recharge quicker.

While efforts have uncovered some promising developments – silicon batteries and solid-state batteries to name two of the most prominent – most continue to utilize lithium in some way. Furthermore, these developments are future-oriented and successful commercialization is still some years away. For the time being, Li-ion batteries continue to be the established and proven choice within a commercialized setting.

ESG concerns around lithium mining

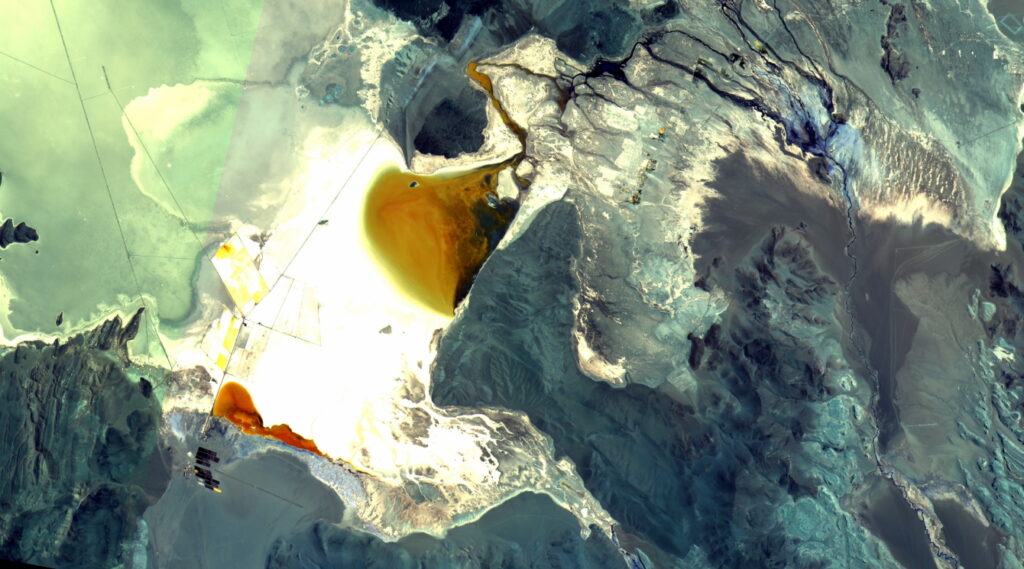

To obtain lithium, it must be mined, and all resource extraction tends to harm the environment in some way. These harms commonly include soil degradation and pollution, ground destabilization, groundwater loss and contamination, noise and air pollution, and negative biodiversity impacts.

There are social impacts to consider too. Worker employment conditions, land access rights, disruption to local communities, pollution concerns, local employment and community investment, and obtaining social license to operate are all on the radar for the mining companies that seek to operate in proximity to established human settlements.

Environmental and social concerns around mining activities are not new of course. However, there is now a far more stringent spotlight trained on them and mining companies need to tread lightly both in how they deal with these concerns, as well as how they communicate their efforts in doing so to their stakeholders and the public at large.

Perhaps nowhere is that spotlight more focused in mining at the moment than on lithium extraction, precisely because of how closely it is tied to the rapid growth of the electric vehicle (EV) industry, itself an outworking of the global push towards renewable energy usage.

ESG concerns around lithium supply chain networks

Supply chain networks can be some of the most difficult components to incorporate within an organization’s ESG strategy. There are two main reasons for this. Firstly, supply chain networks are not under a company’s direct control and secondly, it can be difficult to get proper visibility into the practices and processes of the organizations that operate therein.

Moves are afoot to address this though. The use of scope 3 emissions is one such attempt to bring some transparency to supply chain networks, in this instance, specifically for carbon emissions.

As a growing number of public companies begin to track their scope 3 emissions, for their own reporting purposes they will increasingly require their supply chain partners to track their own emissions too, and it is not difficult to imagine this scenario being extended to other ESG-related issues beyond CO2.

Engaging with lithium-related supply chain partners who cannot accurately provide their own metrics regarding a variety of ESG topics may become a precarious proposition, and public companies may want to limit their exposure as a risk-management exercise.

Companies involved in the lithium supply chain who do not disclose their ESG metrics will likely thus find themselves under increasing pressure to do so, or face being excluded from a rising number of business and supplier networks and relationships.

This development would be good news, as the lithium extraction, processing, and disposal lifecycle faces challenges on multiple environmental and social fronts.

ESG concerns around manufacturing and processing

ESG concerns around the manufacturing and processing of lithium for use in consumer electronics and EV batteries center mainly around the environment, health, and safety (EHS) aspects.

As with most manufacturing facilities, identifying and mitigating all safety hazards involved in Li-ion battery manufacturing processes is a primary concern, and worker safety should be paramount.

Manufacturing also has its own set of environmental-related concerns. Energy consumption and efficiency, water consumption, pollution, and wastage, manufacturing process emissions, and waste disposal are all matters which attract the attention of stakeholders from a sustainability perspective, and should ideally be measured, managed, and reported on via ESG reports.

ESG concerns around product end of life: disposal and recycling

The sheer volume of devices containing Li-ion batteries means that the question of what happens to these batteries when either they or the devices they power reach end-of-life status has become important from a waste perspective. The metals and materials used in batteries can often be recovered, processed, and reused in the manufacture of new batteries, bringing the topic of battery recycling to the forefront of ESG considerations.

Unfortunately, battery recycling is currently not a widespread practice with less than 5% of batteries being recycled due to a combination of technical constraints, economic barriers, logistic issues, and regulatory gaps.

Manufacturers have also not focused on improving the recyclability of lithium batteries due to the lack of incentives to do so. After all, batteries that last long, are light, and recharge quickly are the ones to create market demand and win manufacturing contracts, not those that have a high degree of recycling suitability.

As you may imagine, there are ESG concerns around lithium battery disposal and the waste generated thereof. Batteries that end up in landfills may degrade due to exposure to the elements, revealing harmful metals and materials to human contact. These same substances may leak into the surrounding soil as well as nearby groundwater, poisoning and polluting these parts of the environment.

As such, battery disposal and recycling has come under scrutiny from environmental activist organizations, and the sustainability-related actions taken at this stage of the lithium battery lifecycle now play an important role in the ESG reports of those involved in the supply chain network.

Want to see if our ESG management software is for you?

Boost your ESG ratings and strengthen your reputation for sustainability.