A key performance indicator (KPI) is a quantifiable measure usually used within a business context to evaluate how well a company is performing in a certain area.

KPIs involve collecting relevant data and using it to measure performance, usually with some sort of benchmarked target in mind, whether it be internal (eg. a company’s historical performance or annual targets) or external (eg. how other companies in the same industry are doing on the same performance measurement).

The intent behind measuring KPIs lies in eliminating inefficiencies, failures, and blind spots, and improving performance in key areas which align with business objectives and company strategy.

What are ESG KPIs?

Environment, social, and governance (ESG) KPIs are those applied within a specific ESG-related context or measured against particular ESG criteria.

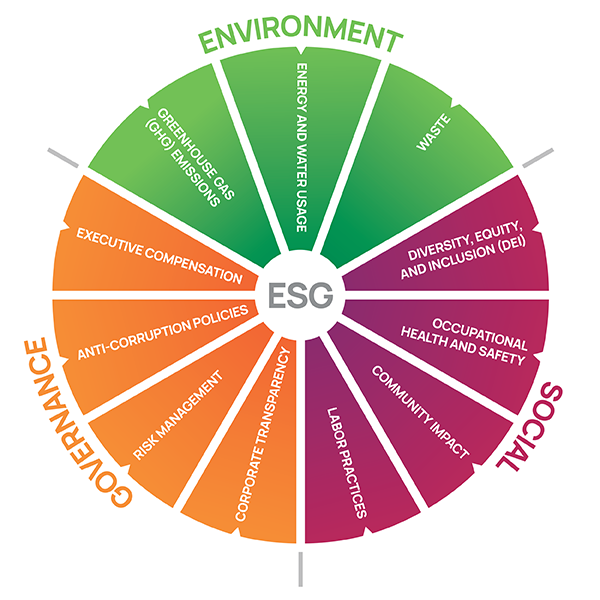

The environmental portion of ESG considers the impacts a company makes upon its physical environment and its utilization of natural resources, while the social aspect relates to how it interacts with people and how they’re impacted by its operations and policies. The governance segment pertains to company policies and how they influence its decision-making across a range of business governance issues.

Thus any performance measurement which is related to these three broad categories of business practices can potentially be termed an ESG KPI.

Why are ESG KPIs important for companies?

In light of the climate crisis and social justice initiatives, environmental, social, and governance (ESG) reporting criteria have become increasingly important in recent years to businesses and organizations across sectors and global regions.

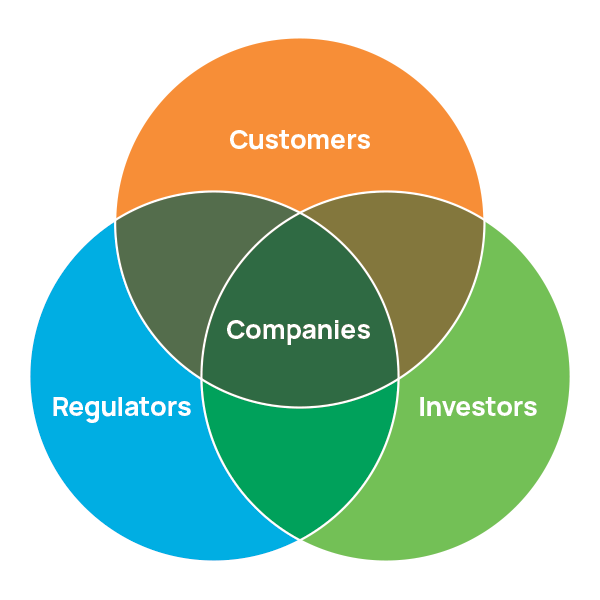

ESG reporting principles pursue transparency and responsible consideration for all an entity’s stakeholders, not just its shareholders. This requires taking a long-term view of risks and opportunities, which should ultimately benefit shareholders through healthier business continuity.

Despite a belief amongst some that ESG is just the latest fad, there is significant evidence to show the immense benefits that identifying, measuring, monitoring, improving, and reporting on ESG metrics can have on all sectors

McKinsey listed five ways that ESG creates value, namely top-line growth (tapping new markets and expanding into existing ones), cost reduction (raw-material costs; the true cost of water or carbon, etc.), reduced regulatory and legal interventions, higher employee productivity (via attracting and retaining quality employees), and the allocation of capital to more promising and sustainable opportunities.1

There is also brand equity and reputation to consider. The consumer public is increasingly aware of and willing to shun businesses that do not pay attention to their efforts in these areas.

With the availability of information online and the interconnectedness of social media, businesses can see their reputations taking a significant knock alarmingly quickly should incidents be perceived negatively, or unfavorable information come to light.

With all this in mind, it’s clear that businesses should make a conscious effort to measure, manage, and improve on their ESG-related activities. Setting KPIs and routinely measuring and evaluating KPI performance in these areas forms an important part of knowing whether an organization is reaching the improvement targets it’s either set for itself or has had imposed upon it by external stakeholders and/or regulations, etc.

What are ESG KPI examples?

Internal ESG KPIs can be almost anything a business wants them to be as long as they fall under the umbrella categories of environmental, social, and governance.

Having said that, there are certain ESG metrics which are very popular to measure company performance against and make a good starting point for creating KPIs in those organizations which may be inexperienced in their ESG management.

Most environmental metrics relate to the total climate impact caused by an organization. Popular measurements here include its greenhouse gas (GHG) emissions, energy and water usage, and waste. Emissions are also categorized as Scope 1 (direct emissions), Scope 2 (indirect emissions from utilities) and Scope 3 (all other indirect emissions such as from a firm’s supply chain).

The diversity, equity, and inclusion (DEI) statistics of an organization’s workforce have been popularized as the de facto social metrics of late. However, social metrics also incorporate factors such as occupational health and safety, community impact through service and investment, product quality and safety, and labor practices as they relate to living wages, employee satisfaction, and training and professional development.

Governance metrics encompass the composition of the oversight body (usually the board of directors), executive compensation, anti-corruption policies, risk management, and overall corporate transparency.

Because there are so many potentially measurable aspects of ESG, there has been a push to standardize sets of metrics via initiatives such as the ESG Data Convergence Initiative (EDCI) for example.

The EDCI seeks to greatly reduce the amount of ESG KPIs gathered to streamline the private investment industry’s previously fragmented approach to collecting and reporting ESG data.

The Initiative aligned on six categories for the 2021/2022 cycle, including GHG emissions, renewable energy, diversity of board members, work-related injuries, net new hires, and employee engagement.

Other common ESG and sustainability reporting organizations, standards, and frameworks include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-Related Financial Disclosures (TCFD), CDP, and the International Sustainability Standards Board (ISSB).

These are all examples of international organizations that have created and formalized their own set of ESG metrics in an attempt to bring a level of standardization to company ESG measurements and disclosures.

How can you track ESG KPIs using software?

Businesses generally measure and track ESG KPIs via ESG management and reporting software. This is due to its ability to collect and aggregate data in one system, as well as the immediacy of analysis available.

In fact, software can be used throughout the ESG management lifecycle to add considerable utility at each phase of the process.

In the data gathering phase, one may be able to choose from a library of templates or create customized queries to gather applicable ESG data. Some ESG software may contain a built-in calculation engine to assist with determining CO2 emissions. Another big plus is its ability to efficiently roll up KPI performance and metrics for ESG reporting purposes.

However, in terms of tracking ESG KPIs, probably the biggest advantage of ESG software is its ability to visualize ESG data in analytics dashboards for real-time situation analysis.

Dashboards with graphs and graphics that contain all your high-level metrics and KPI info in one place provide an excellent method of displaying progress at-a-glance and tracking improvement towards ESG goals. Software configurability means that interfaces can usually be personalized to show the key metrics that are important as well.

The data being used to compile and track the ESG KPIs is usually more accurate and complete when utilizing software too. This is because information is no longer siloed within different organizational departments, instead being aggregated on one software platform.

ESG data can be inputted from different people and departments throughout the company into one central location whilst third-party integration, provided the functionality exists, enables information to be collected from other business software systems as well.

Of course, data is only useful if organizations can act on it. Good ESG management software will often contain some type of action management functionality designed to create action plans to reach and exceed KPI goals, task and schedule employees with related actions, monitor progress, and incorporate feedback.

What is the future of ESG KPIs?

ESG KPIs will likely evolve in line with the standards and frameworks of the international organizations that are assisting to standardize ESG measures globally.

Although companies will continue to need to set their own individualized KPI measures in-line with their strategic objectives, it makes sense that these will also increasingly align to the standardized metrics provided by ISSB, TCFD, CDP, GRI, and the World Economic Forum.

As rising numbers of businesses internationally adopt these ESG frameworks and standards, the performance they achieve on these metrics will provide a useful frame of reference for others on which to benchmark their own ESG KPI performance, and we can expect to see growing alignment between KPIs and industry standards as the ESG landscape matures.

1 https://www.mckinsey.com/~/media/McKinsey/Business…

Interested in learning more about ESG software?

Frequently asked questions (FAQ)

How often should companies measure and report on their ESG KPIs?

Frequency varies, but regular measurement is essential to track progress and identify areas for improvement. Many companies report annually.

Can ESG KPIs be linked to financial performance?

Yes, companies are increasingly recognizing the link between strong ESG performance and long-term financial sustainability.

Are there standardized ESG KPIs?

While some KPIs are standardized across industries, ESG reporting frameworks like GRI and SASB provide guidance on selecting and disclosing relevant KPIs.

Which ESG KPIs are typically reported by companies?

Common ESG KPIs include carbon emissions output, renewable energy usage, recycling and waste reduction initiatives, social and community engagement initiatives, gender diversity ratio, employee turnover rate, and board diversity amongst many others.

What are some common ESG KPI categories?

ESG KPIs can be grouped into categories such as environmental impact, employee well-being, community engagement, corporate ethics, and more. ESG reporting frameworks like ISSB, GRI, SASB, and TCFD can provide guidance on these.