Key Takeaway

ESG reporting may not be mandatory yet, but disclosing your ESG performance can still be beneficial to your company.

There was a time when a company’s financial performance was enough to convince investors to buy stocks. But times have changed.

Investors now want to base their decisions on a more nuanced overview of a company. They will glimpse at the organization’s values, take into account their planning and accountability, and assess whether their operations are sustainable. Modern investors want to know that their capital is backing organizations that are both ethical and able to go the distance.

As a result, there is increasing pressure on companies that are seen as contributing to climate change, resource depletion, and damage to the community to change their ways or go the way of the dinosaur. Or to put it bluntly: adapt or die!

If values-based performance is important to corporate success, so is tracking it. Doing so is the only way for a company to ensure that it is continually improving – and proving itself to be a worthy investment.

Soon, tracking the sustainability of your organization won’t be enough – you will also have to report it. But you shouldn’t wait until reporting requirements are in place. There are good reasons to start tracking and gathering this information now, even if you’re not legally obligated to do so yet.

ESG Reporting

This type of tracking and reporting is often referred to collectively as ESG programs – Environmental, Social, and Governance.

Taken together, these activities and initiatives create a picture of a company’s ethical practice and sustainability, both of which are important to the future outlook of any organization. These metrics matter in the short term as well, as they earn more confidence and interest from investors.

Companies that are tight-lipped about their environmental and social impact are seen as having something to hide, and new generation investors will be cautious when dealing with an organization that doesn’t lay all of its cards on the table.

The Value of Disclosing Your ESG Performance

Sustainability reporting is, for now, an elective activity. But disclosure requirements are already coming in Canada and Europe. And while not yet compulsory in the United States, the SEC is expected to issue its ruling on climate-related disclosures by the end of the year.

It is, nevertheless, becoming a focus for organizations – and for good reasons.

With regulations just around the corner, no company wants to be caught scrambling to set up a tracking and reporting program at the last minute. While it’s certainly possible to create such a program in a relatively short time frame, establishing one that is effective, robust, and inspires confidence in the organization takes time. Getting a head start ensures that all the right data is collected and analyzed by the time requirements come into play.

Even if there were no regulations requiring it, engaging in ESG disclosure would still have value. Making this information public shows a commitment to transparency, a willingness to be accountable for current performance, and plans for improvement.

Companies that voluntarily disclose sustainability reports also give themselves the opportunity to give qualified context for their performance, such as explanations of why targets were missed, risks and opportunities, and actionable plans for improving by the next report. In essence, they take charge of their narrative rather than letting others tell the story for them.

However, it’s not as simple as releasing some toothless, feel-good statements about the environment, complete with a backdrop image of a forest (I live in oil country, we see this a lot!). A proper disclosure needs to have some real numbers and context to support it.

The Global Reporting Initiative (GRI) sets a standard that is widely used for ESG reporting, and provides guidance on how to do it. The newly-formed International Sustainability Standards Board (ISSB) also recently published two supplementary guidance documents: “IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information” and “IFRS S2 Climate-related Disclosures.”

The Right Way to Do ESG Disclosure

The coming standards are a good thing, since it means companies will no longer be flying blind in terms of disclosure expectation.

Without robust standards in place, there is still a risk of getting it wrong when releasing ESG performance reports. Disclosures can be perceived as disingenuous “greenwashing” rather than accurate and reliable reporting. A report that leaves out key information can be seen as an attempt to paint a rosier and greener picture by omitting areas of the operation where ESG performance is weaker.

(Find out How to Track Your ESG Performance)

Being accused of greenwashing is more than just a bad look. Since 2021, the SEC has started implementing rules and a taskforce to enforce ESG reporting. On top of that, a wave of private plaintiff lawsuits has been levied against organizations for greenwashing, and becoming embroiled in costly and newsworthy lawsuits may further damage an organization’s reputation.

This kind of lawsuit has held companies’ feet to the fire on everything from ESG qualifications as a fund/stock, to misleading and inaccurate claims on product packaging. If a product is being sold as “net zero” or “reef safe” or “ethically sourced”, these have specific ESG implications that must be corroborated with data.

For all these reasons, a robust ESG program should be a priority for companies. The program should be integrated and distributed across the organization, rather than siloed and performative. This can be facilitated through purpose-built ESG software that streamlines data collection and reporting.

Most ESG solutions will have processes guided by reporting standards and regulations, helping organizations collect critical data and automate complex analyses (such as greenhouse gas calculations, which can be difficult to manage).

However, even with the backing of a well-designed software solution it takes time to establish the kind of strong foundation of data that makes reporting more reliable and consistent. Waiting until disclosure becomes a hard requirement is a poor strategy that can lead to reputational (and financial) damage.

Furthermore, there is a positive appearance for a company that chooses voluntary disclosure without having to be made to do so. As those rules appear to be coming down the pipe, and non-regulatory pressure from industry groups, business partnerships, financial organizations is already forcing the hand of businesses, time is short to get ahead of it and take advantage of the optics of voluntary participation.

Start Disclosing Now

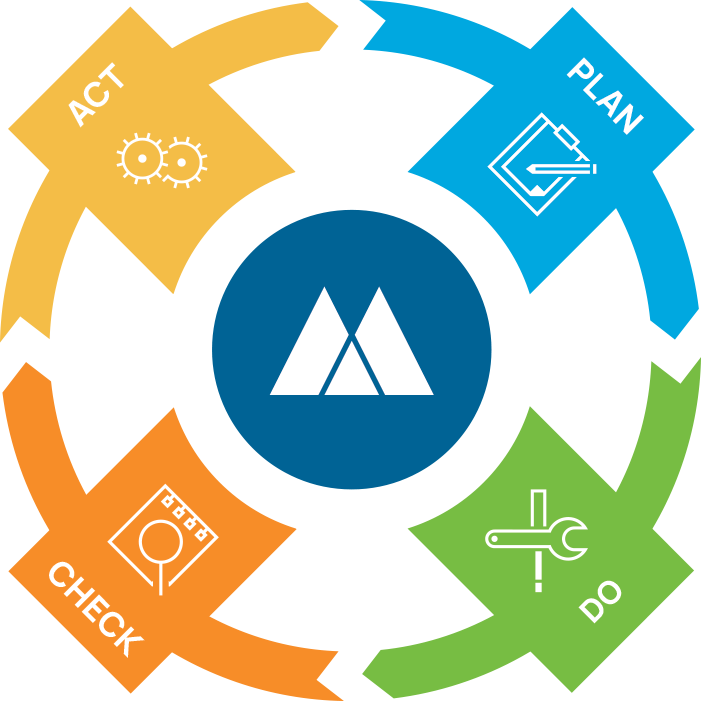

Building the programs required to support ESG compliance takes time, and organizations have to be realistic about the turnaround. A well-realized ESG system should include all stages of the PDCA cycle (Plan-Do-Check-Act), which involves analysis and planning, operationalizing those plans, checking that the processes are working as intended, and making improvements.

The system also needs a mechanism for ensuring the integrity of its numbers and the performance of its processes, for which it needs a pool of data. Even at the most basic level a company would be foolhardy to release data without letting this cycle run at least a year.

Considering the lag time and need for integrity, companies need to get busy building ESG systems soon if they haven’t already. Chances are it will soon become a requirement, and scrambling to get it together at the eleventh hour increases risk of errors and omissions that could seriously harm a company’s reputation – or their books!

Boost your ESG ratings and strengthen your reputation for sustainability.