What You Should Know About the Consolidated Mining Standard Initiative

Metals and minerals and the mining processes that extract them play critical roles in a more sustainable future. Demand for metals and minerals to produce batteries, turbine generator magnets, wiring, fuel cells, and other essential green energy components has surged.

According to the International Energy Agency (IEA), demand for lithium grew 30% year over year in 2023, which is on top of impressive 200% growth from 2017 to 2022. Other critical battery minerals including cobalt, nickel, and copper saw demand increase during the same 2017 to 2022 time period by 70%, 40%, and eight percent, respectively.

Moreover, the IEA emphasizes the potential for mining of materials used in clean energy to raise some of the world’s poorest people out of poverty.

Changing consumer preferences trend toward sustainability

We are in an era where consumers are more informed than ever and have made sustainable goods and corporate responsibility important criteria in their purchasing decisions.

According to the global consultancy Simon-Kucher, 64% of consumers rank environmental sustainability as a top three purchasing consideration after price in their 2024 study, indicating that it’s becoming more of a consumer requirement than a nice-to-have. Simon-Kucher also reports that approximately 70% of consumers will at least sometimes research sustainability claims for the brands they use.

Investors know this. Regulators know this. Corporate transparency laws to disclose non-financial metrics are emerging across the world from the common spin-offs of IFRS S1 and S2 to the more rigorous CSDDD in the EU. While some see the reporting burdens as unreasonably high, others will argue that unchecked and unmitigated climate risks can lead to natural disasters, which governments, investors, and consumers all want to avoid.

Sustainability examination at the site level

Intense scrutiny is nothing new for mining and metals firms and other natural resource companies who have long faced interrogation from communities, regulators, and customers over the responsibility of their operations.

When operating on a decades-long timeline from exploration to development and production to, ultimately, closure, mining firms need to take a long view of their impacts and the factors that will remain important over time, much more so than businesses in less location-reliant and resource-intensive industries.

Accounting for environmental, social, and governance (ESG) risks is incredibly important for investors and lenders when evaluating mining operations as well. Managing these factors poorly in the near term can prevent mines from realizing profitability years down the line.

Mining operations need to address land use, resettlement, energy and water consumption, biodiversity, and local investment, along with workplace and community safety, health, and hygiene for permission to operate. Positive performance and good standing with stakeholders can unlock funding and more development opportunities. At best, poor performance in these categories means unsustainable expenses and negative return on investment; at worst, the impacts can cost people their lives.

Reporting and disclosure standards

Mines and their parent firms cannot simply ignore the macroeconomic environment, however. Demand for sustainability and corporate responsibility across sectors has ballooned in the past few decades, making reporting standardization necessary as a means for comparison.

Sustainability and ESG standards like GRI and SASB have attempted to measure impact in comparative ways while accounting for sector-specific nuances. Mining associations and governing bodies have also devised their own responsible mining disclosure standards including The Copper Mark and the Mining Association of Canada’s Toward Sustainable Mining (TSM) standard along with standards produced by the International Council on Mining and Metals (ICMM) and the World Gold Council.

The proliferation of disclosure standards has created a complex and sometimes confusing landscape not only for the mining and metals firms deciding which to report against, but for customers, communities, investors, and other stakeholders to navigate as well. When several standards attempt to measure similar data with different nuances, the measurement inherently becomes non-standard and difficult to compare.

The Consolidated Mining Standard Initiative (CMSI)

But there’s hope! After convening in 2023, The Copper Mark, TSM, ICMM, and the World Gold Council embarked on creating a consolidated standard that includes key stakeholders, withstands scrutiny, supports public trust, and provides clear criteria and a defined path to responsible mining.

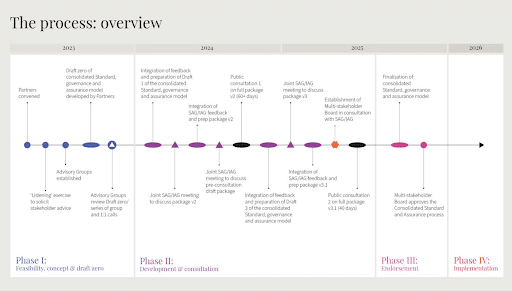

According to CMSI, “The process has been guided by two advisory groups: one comprising industry representatives (the Industry Advisory Group), and the other bringing together a diverse range of voices from stakeholders including NGOs, investors, Indigenous groups, customers and multilateral organizations (the Stakeholder Advisory Group). Members of these groups have worked together to leverage their expertise to support the development of the Standard and multi-stakeholder oversight system.”

The first draft of the CMSI was released in October 2024 with the first public consultation ending in December. CMSI’s next steps are to release a consultation report and open a second round of public consultation. See a more complete picture of the anticipated process overview below.

How mining companies should prepare

While the consolidated standard is still being refined, mining companies should continue disclosures according to the responsible mining standards which they have previously reported. Although the implementation outline for the consolidated standard is clear, potential setbacks could delay its adoption. Mining firms must avoid losing stakeholder confidence while waiting for the new disclosure standard.

Reporting responsible mining is difficult whether a firm discloses to a single or multiple standards. It requires involvement from multiple stakeholders and systems, calculations and ratios to measure greenhouse gases and other impacts, assurance, and visibility to track progress against goals. To reduce complexity, streamline data collection and reporting, and improve auditability, many mining companies have adopted purpose-built software solutions for sustainability reporting.

As a leading HSEC software solution supporting global mining companies for over 25 years, IsoMetrix supports firms looking to disclose in accordance with responsible mining standards. IsoMetrix helps mining companies reduce the time and effort needed to collate and produce sustainability reports and do so with greater confidence.

With less time and resources dedicated to disclosures along with greater confidence and visibility, mining leaders can focus more on developing and managing initiatives to mature their responsible mining impacts that will resonate throughout the value chain and circular economy.