Quick Summary:

This article discusses the Corporate Sustainability Due Diligence Directive (CSDDD) which aims to hold large EU companies accountable for environmental and human rights impacts across their value chains.

It outlines CSDDD requirements, including reporting obligations and alignment with climate goals, while noting concerns over how the regulation was weakened during its development process.

It also highlights how the upcoming CSDDD implementation underscores the necessity for companies to modernize their ESG management and reporting systems, with software solutions being key.

The European Union (EU) has been the scene of much action on the corporate sustainability front over the last few years, and the latest regulation to be developed within this space is the Corporate Sustainability Due Diligence Directive, or CSDDD.

Approved by the European Parliament on 24 April 2024, the directive still needs to clear further voting hurdles in May, but currently remains on track to adoption by the EU.

Earlier regulations in a similar vein include the EU Corporate Sustainability Reporting Directive (CSRD) which requires organizations to report on sustainability information annually, the European Sustainability Reporting Standards (ESRS) comprising a set of EU compliance and disclosure requirements that form the framework for the CSRD regulation, and the Sustainable Finance Disclosure Regulation (SFDR) that concerns sustainability disclosures in financial market participants’ investment policies and products.

The CSDDD requires large, EU limited liability companies to identify, minimize, and prevent where possible, any potential environmental and human rights damage or harm caused by their own activities, as well as those of their subsidiaries, and value chain partners.

Furthermore, certain large companies will need to align their business strategies with limiting global warming to 1.5°C in line with the Paris Agreement, as the CSDDD seeks to support the European Green Deal’s efforts towards reducing net greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels.

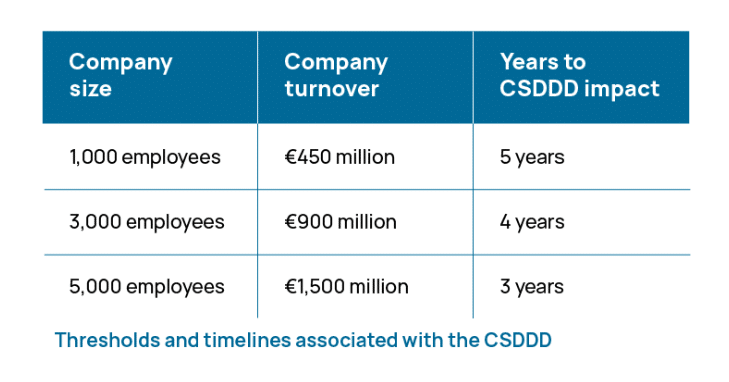

Eligible companies – those with more than 1,000 employees and revenues of €450 million or more – will need to document and report on their activities in these areas, and conduct due diligence not just on their own operations, but also on the activities of their subsidiaries and other entities within their value chains.

Large companies will be held accountable for unprecedented details of their supply chain partners, whilst the companies in their supply chains will need to provide quality data, or risk losing customers due to non-compliance.

Non-EU companies that conduct a set level of business in the EU will also fall under the CSDDD and could similarly become liable for their actions and those of their suppliers.

Although the regulation is being touted as the latest example of an ESG-related rule which has been substantially watered-down from its original intent with the March update (company eligibility thresholds have been raised since an earlier version of the proposal), and observers have raised concerns over its ability to impact corporate sustainability practices, it nonetheless reflects the broader trend of increasing regulations around corporate sustainability, particularly within the European market.

Although not expected to go into effect for a couple of years, it is clear that businesses will need to focus on the significant changes they’ll need to make to comply with this and other corporate sustainability rulings, if they haven’t already begun to do so.

It’s also indicative of the seriousness which companies will need to apply to the capabilities of their own ESG management and reporting systems. Historically, organizations have been able to pay lip service to the concept of corporate sustainability, and perhaps even indulge in a bit of greenwashing if so inclined.

With ever-strengthening regulations and enforcement however, companies at all levels of the value chain will need to thoroughly modernize their ESG management and reporting capabilities to meet the disclosure requirements of their limited liability customers.

Software can help large companies engage with suppliers, collect data in many different formats, and establish good management and reporting processes, whilst small companies can use it to enhance their reporting without needing to scale their resources in parallel.

ESG and sustainability managers need to evaluate the capabilities, features, and suitability of competing ESG software tools in the market, whilst CIOs, CTOs, and IT teams will be increasingly called upon to evaluate technology features such as scalability, integration capabilities, and data security measures as well.

Digital solutions that can help companies efficiently collect, manage, analyze, and report on their ESG data will play an integral role in not only enabling them to meet their disclosure requirements, but in promoting transparency and accountability with their own investors and customers too.

The IsoMetrix Resource Library contains various assets which address some of these topics.

The guides and whitepapers in this website section are intended to be easy-to-read yet informative introductions to various topics within the ESG sphere, and include: