This article is part two of a series on regulatory changes in Canada regarding ESG reporting.

Read part one and part three.

IsoMetrix Lumina ESG software can assist your business in dealing with these changes effectively and efficiently.

Discover How

Next year is shaping up to be a big year for Canada in terms of introducing mandatory new ESG regulations.

Not only will the country’s banks, insurance companies, and federally regulated financial institutions need to publish climate-related risks and disclosures, but the Canadian government is addressing forced labour in Canadian supply chains via Bill S-211 An Act to enact the Fighting Against Forced Labour and Child Labour in Supply Chains Act and to amend the Customs Tariff.

Expected to come into force on January 1, 2024, and containing two parts, the bill comprises:

(a) The reporting obligation:

An obligation on certain entities and government institutions to submit an annual report to the Minister of Public Safety by May 31 of each year on the steps taken during the previous financial year to prevent and reduce the risk that forced labour or child labour is used by them or in their supply chains.

(b) A change to the customs tariff:

An expansion of the prohibition on the importation of goods mined, manufactured, or produced, in whole or in part by forced labour, to also include child labour.

Entities must either be listed on a stock exchange in Canada or have a place of business in Canada, do business in Canada or have assets in Canada and meet two of the following three criteria for at least one of their two most recent financial years:

- $20 million or more in assets

- $40 million or more in revenue

- 250 or more employees

Once the Act comes into force, entities must, on or before May 31 of each year, submit a report to the Minister of Public Safety encompassing their actions to prevent and reduce forced labour or child labour across production and supply chains, as well as detailing a host of other measures such as their forced and child labour policies, remediation and support for affected families, employee training, etc.

Entities must make the report available to the public, including by publishing it in a prominent place on its website. For entities incorporated under the Canada Business Corporations Act or under any other Act of Parliament, the report must also be distributed to each shareholder, along with its annual financial statements.

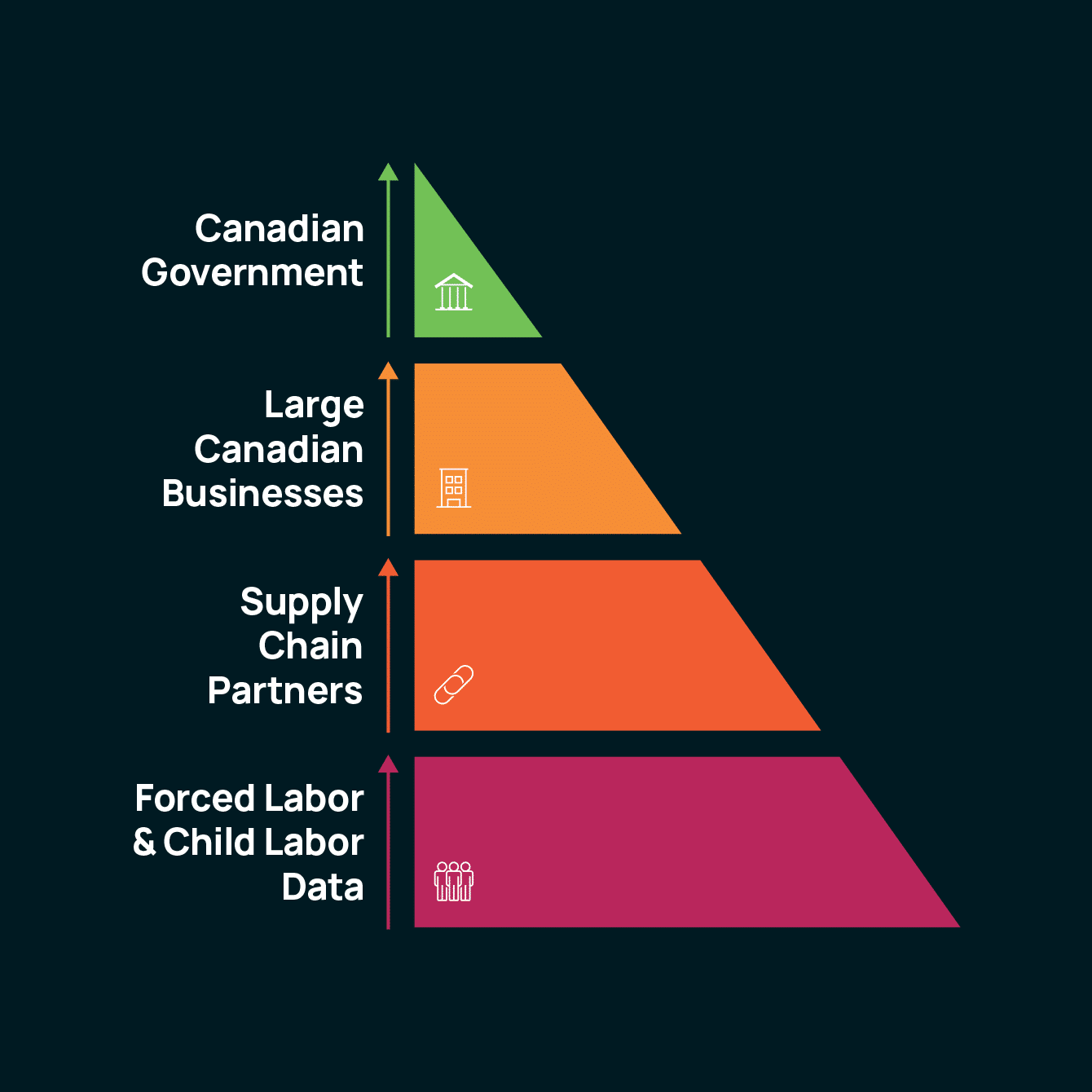

While the Act is specifically aimed at larger Canadian businesses, it will have a knock-on effect on all their supply chain partners as well. With these larger entities being obligated to report on their supply chains, relevant business partners will need to disclose their own information relating to forced and child labour too.

Compliance aside, Canadian companies will want to disclose this information from a risk mitigation standpoint. Reputation and brand image are key in today’s connected business landscape, and consumers and stakeholders increasingly value ethical and environmentally friendly businesses.

Demonstrating transparency with regards to forced and child labour will assist businesses to build trust with their stakeholders, including their customers, investors, and employees. Conversely, an inability to adequately report on this issue may hurt them in terms of both their existing supply chain relationships, as well as their future business opportunities.

For companies looking to manage their ESG performance and disclose information pertaining to specific topics like forced labour and child labour, dedicated management and reporting software offers several advantages.

These include streamlined data collection, centralized data aggregation, performance dashboards, action management, and automated reminders. ESG software also facilitates the creation of comprehensive and standardized reports, making it easier to communicate regulation compliance to stakeholders, and in this particular case, supply chain partners.

With the mandate likely coming into effect in 2024, companies should already be investigating implementing ESG management and reporting software to assist with the associated data collection, management, and reporting processes that will need to follow as a result.