An introduction to the foundational aspect of any organization’s ESG management and reporting process.

Data forms the foundation for all situational analysis. It is what enables an organization to see its current position clearly, reveals opportunities, and uncovers threats.

An auditor will tell you that extracting and analyzing client data enables an understanding of a client business and the risks it is facing. The better the data, the clearer and more informed the situational analysis will be.

As Peter Sondergaard, former Executive Vice President at Gartner put it, “Information is the oil of the 21st century, and analytics is the combustion engine”.

Why Collect ESG Data?

Climate change and sustainability are ever-present topics in the media, and organizations now need to pay genuine attention to the ways in which they manage and report on their sustainability operations.

Companies are increasingly needing to plan for their environment, social, and governance (ESG) disclosure requirements, with new comprehensive mandatory climate and ESG disclosures adding a significant compliance dimension.

In an increasingly digital world, data has become vitally important. In industries which feature mandatory ESG compliance and regulation, high-quality data can mean the difference between compliant operations and expensive penalties.

Increasingly stringent regulations are going to require better data management at all stages of the process, from identification and sourcing through to integration, centralization, data security, analysis, and reporting.

ESG data collection is evolving from a ‘nice to have’ to a ‘must-have’ for investors. It’s the lens through which they assess a company’s resilience and long-term value.

– Anonymous Author

Key Benefits of Good ESG Data Collection

While each stage is important, the ability to gather timely and accurate data forms the foundation for the rest of the ESG process.

Gather the correct data and the remaining process becomes logical and straightforward. Gather the wrong data or mismanage the procedure however, and the entire process falls apart.

Benefits of reliable and consistent ESG data include:

- Strengthening a company’s control of its own environment and processes

- Driving business growth and creating value for a company

- Providing the ability to identify trends, risks, and opportunities

- Facilitating comprehensive reporting

- Enabling meaningful forecasting

- Making auditing simpler, easier, and less time-consuming

- Assisting in meeting reporting deadlines

The Spectrum of ESG Data Challenges

ESG data can take many forms and be generated from a multitude of sources. It can be frequent or periodic, structured or unstructured, and can reside in different systems, in different formats, and with various people within a siloed organization.

This huge variety leads to data quality challenges that need to be overcome if the data is to be meaningful, usable, and easily reported upon.

Other challenges to gathering good quality and usable data include:

- Unavailability

- Inconsistency (e.g. incorrect format)

- Incompleteness

- Inaccessibility

- Inaccuracies due to human error when capturing the data

- The potential to be incorrectly calculated

- It can be time-consuming to obtain

- It may be vulnerable due to a lack of adequate security measures

Ensuring an Effective ESG Data Collection Process

To gather data effectively and lay the foundation for successful ESG management, companies can follow a few steps to set them up for success.

- Identify: Identify the specific data being collected and confirm the reason for collection.

- Locate: Locate sources of the data and consider how to assess its quality.

- Centralize: Decide how data will be collated in a secure, accessible, and auditable way.

- Analyze: Examine data for insights and review its quality.

- Generate: Compile reports and distribute to stakeholders.

Automated vs Manual ESG Data Gathering

Manual ESG data collection occurs when people monitor data sources and manually capture the data into whatever data organization tool they are using, often an Excel spreadsheet.

Despite the advent and ensuing popularity of digital technologies, many organizations still rely on manual data collection, which can be a time-consuming and labor-intensive approach.

As the name suggests, automated ESG data collection is done automatically using software with built-in integrations to all the necessary data sources. As new data is added to each source, it automatically flows through to the software platform where it accumulates, ready for analysis.

As the data is added in real-time, analysis can usually be conducted on the most up-to-date set of information, improving situational visibility, and aiding operational and strategic decision-making.

What are some of the most common ESG data metrics?

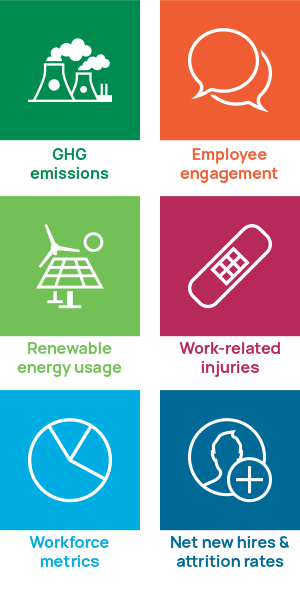

Listed below are some of the most common ESG metrics on which businesses gather and track data, as a measure of their performance.

- GHG emissions – eg. Scope 1, Scope 2, and Scope 3 emissions data

- Employee engagement – eg. Employee surveys and responses

- Renewable energy usage – eg. What percentage of energy use originates from green energy sources?

- Work-related injuries – eg. Number of incidents, injuries, fatalities, days lost due to injury, and long-term injury frequency rate

- Workforce metrics – eg. Company diversity. What percentage are women? What percentage are from under-represented population groups?

- Net new hires and attrition rates – eg. Number of new hires and employees who have left the company

ESG data gathering is a foundational part of any organization’s ESG management and reporting process and is thus extremely important. The task can be improved by employing technology to assist with various aspects of the ESG data gathering and management process.

A single, secure, and centralized ESG management software platform can boost process efficiency, save time on reporting, and support operational and strategic ESG decision-making.

Boost your ESG ratings and strengthen your reputation for sustainability.

ESG Data Collection Frequently Asked Questions

Does ESG data collection change depending on your country?

ESG data collection can vary between countries as different places have their own legislation, regulations, cultural norms, and standards for measuring ESG factors.

Reporting requirements, guidelines, and metrics can all differ from country to country, so organizations need to have a good understanding of their own particular ESG landscape to collect the right data.

How much would it cost to invest in a ESG data software?

The cost of ESG data software can vary based on factors like the features offered, organization size, and data management needs, whilst pricing models may include upfront costs, licensing fees, subscriptions, or customization charges.

To get an accurate cost, it’s best to contact software providers directly and discuss pricing based on your organization’s specific ESG requirements.

What types of data are collected for ESG reporting?

ESG data includes information on energy and water consumption, carbon emissions, diversity in the workforce, labor practices, board diversity, executive compensation, and more.

What challenges do companies face in ESG data collection?

Challenges include data accuracy, consistency, comparability, data source verification, and determining which data points are material to the company’s ESG performance.

What are the benefits of using technology for ESG data collection?

Technology can automate data collection and provide a single platform for data storage, eliminating siloed data.

Do companies need to report all collected ESG data?

Companies should focus on reporting data that is material to their industry, operations, and stakeholders. Not all collected data needs to be disclosed, but companies may want to seek expert advice when determining what data to disclose.