Sustainability Regulations are Evolving

Are you Prepared for the EU's Carbon Border Adjustment Mechanism (CBAM)?

The Carbon Border Adjustment Mechanism (CBAM) is a tariff on carbon-intensive products imported by the EU and is initially being applied to products in various carbon-intensive sectors such as aluminium, cement, iron, and steel.

Exporters outside the EU will need to demonstrate that their products meet specific emissions benchmarks or pay the CBAM levy. This, in turn, will require robust reporting and verification mechanisms to ensure accurate assessment of any emissions associated with the production of the imported goods.

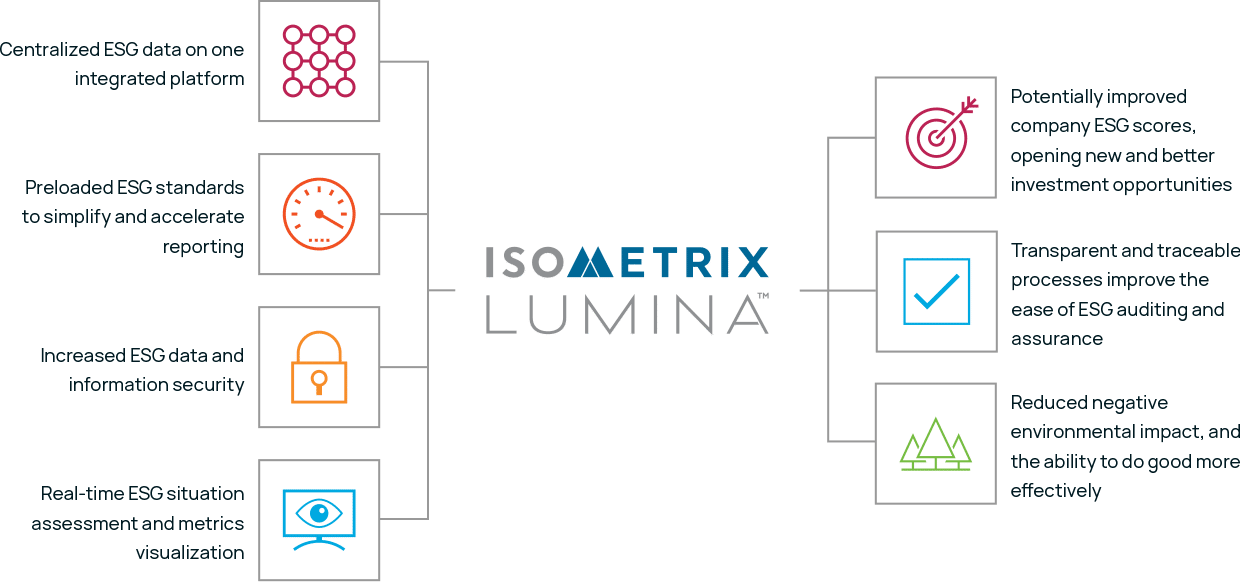

IsoMetrix Lumina ESG software is the ideal tool to assist your business in navigating this new sustainability regulation.

How Can IsoMetrix Lumina Help?

CBAM Compliance Made Easy

Upstream and Downstream Emissions Management

A Built-in Carbon Calculation Engine

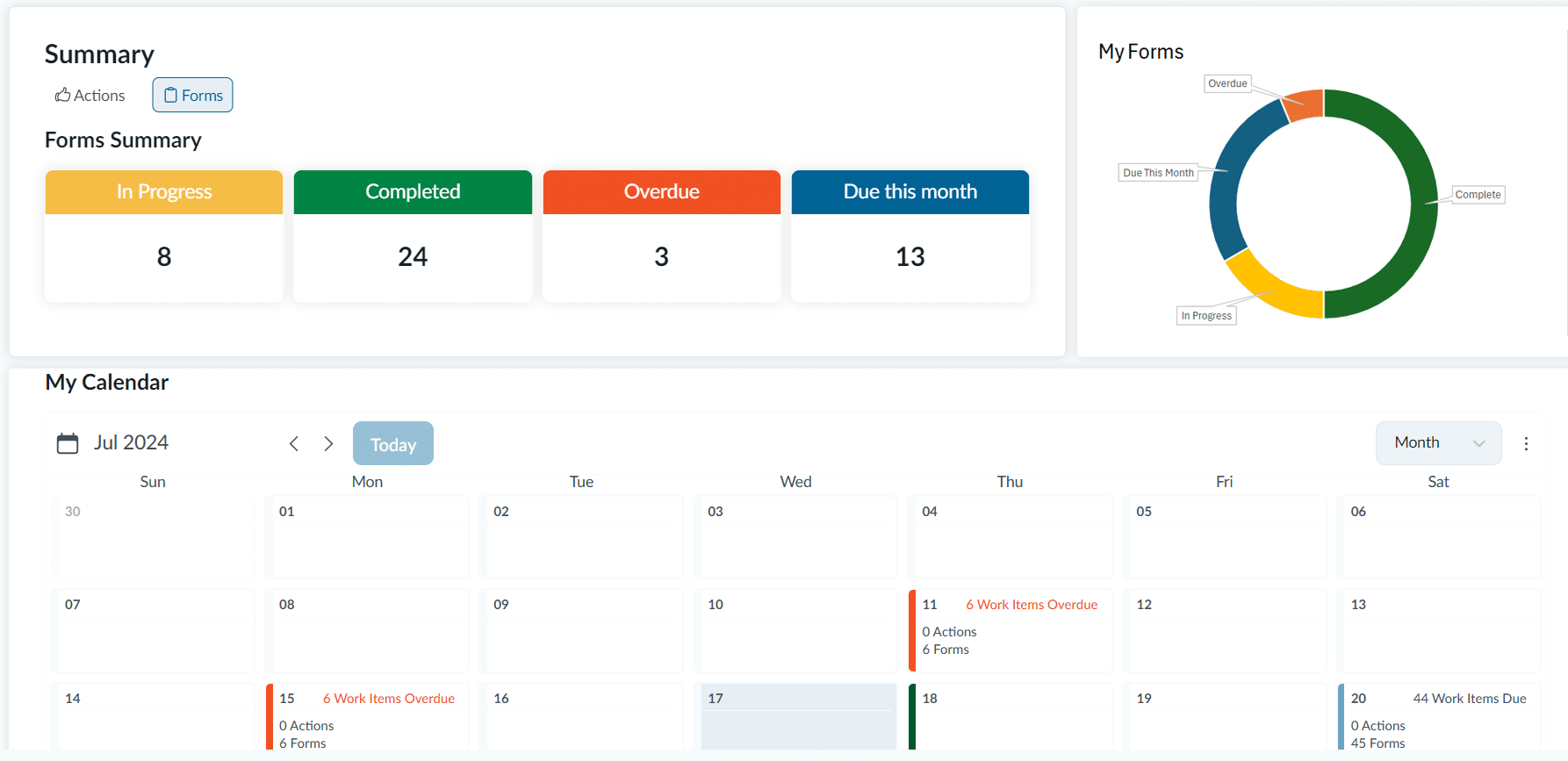

Improved Data Quality and Collaboration

Don't wait until CBAM compliance becomes a daunting challenge! Embrace the regulation with IsoMetrix Lumina ESG software.